DOMESTIC VIOLENCE AND RAPE CRISIS TAX CREDIT APPLICATION

DOMESTIC VIOLENCE AND RAPE CRISIS TAX CREDIT

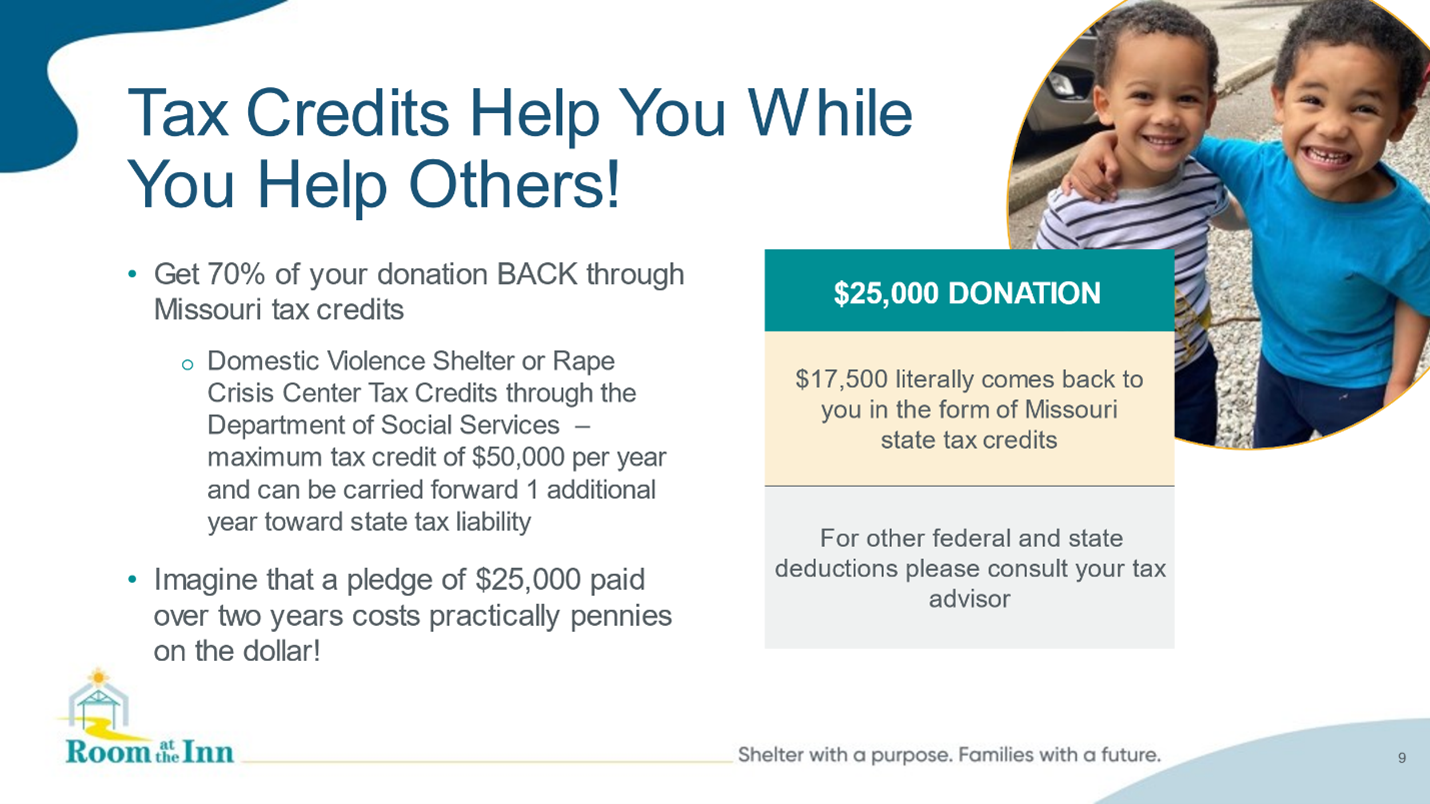

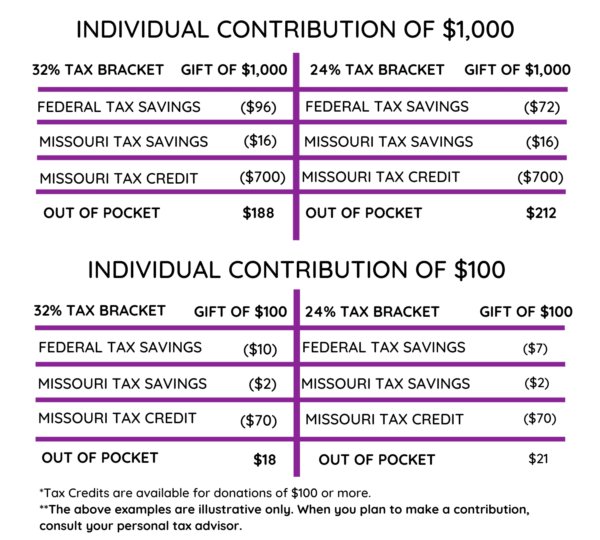

As with most charitable donations, the donor may claim a federal income tax deduction. The Missouri Domestic Violence & Rape Crisis Tax Credit allows the donor a credit equal to 70% of the monetary contribution to Room at the Inn. This credit is applied against the donor’s Missouri state tax liability. Donors may claim up to $50,000 for a Domestic Violence & Rape Crisis Tax Credit which equates to a $71,429 donation. The Missouri Domestic Violence & Rape Crisis Tax Credit application must be submitted within one year of the donation date. The credit may be carried forward one year.

HOW TO APPLY FOR A DOMESTIC VIOLENCE AND RAPE CRISIS TAX CREDIT

When you make your donation, please let us know if you would like to apply for the Domestic Violence & Rape Crisis Tax Credit. We will include an application along with your donation acknowledgment letter. Or to access the application online and fill it out digitally, just click on the button below.

Please complete the checked fields and mail the application to:

Room at the Inn

3415 Bridgeland Dr

Bridgeton, MO 63044

The following is intended to address general questions related to Room and the Inn Domestic Violence & Rape Crisis Tax Credits. Room at the Inn does not provide tax advice. For any matters related to your personal tax status, ability to file and/or use a Domestic Violence & Rape Crisis Tax Credit, we suggest you contact your tax professional.

FREQUENTLY ASKED QUESTIONS

- What names should be on the tax credit application?

The names on the tax credit application must appear in the same manner as you file your income taxes. Likewise, if there are two names on the application, both social security numbers are required as well. - If I made multiple donations, should I list all the dates?

Only write the most recent donation date on the application for the total donation amount. - Can I email my tax credit application back to you?

No, the state required the donor’s original signature. - Can I mail my tax credit application to the state?

No, the Executive Director of Room at the Inn must sign the application before it is mailed to the state. - When will I receive my tax certificate?

It takes approximately 6-8 weeks for the state to process your Domestic Violence and Rape Crisis Tax Credit application. The state will send your tax certificate directly to you. - Who should I call if I have questions?

Please call, Debbie Tolstoi, Admin Coordinator at 314-209-9181. - Where should I send my application?

Room at the Inn

3415 Bridgeland Dr

Bridgeton, MO 63044

For questions, contact

Laurie Phillips, Executive Director, at lphillips@roomstl.org

or call 314-209-9181.